March ‘25 Market Update

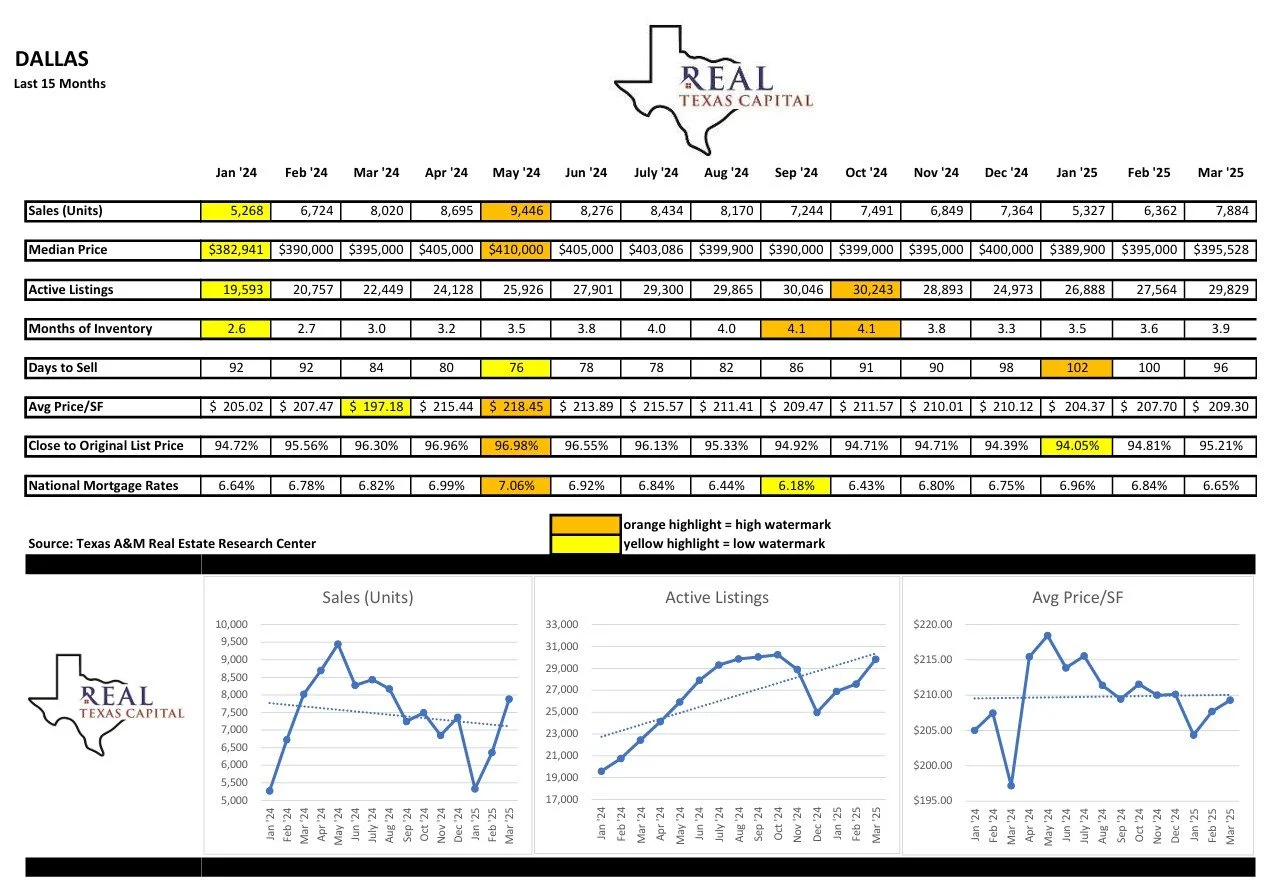

Last month, we observed that Texas’ four major markets (Austin, Dallas, Houston, and San Antonio) were mixed but possibly showing signs of strengthening. As we approach the selling season, the most recent data is showing a relatively weaker market in March 2025 as compared to the previous year’s March 2024 entrance into the selling season. When comparing March 2025 to last March’s data, ALL FOUR markets resulted in lower unit sales, increased active listings, increased months of inventory, longer time-period to sell, and decreased close to list price percentages.

Despite the above softening market trends in Texas, pricing isn’t showing consistent results among these markets year over year comparisons. Specifically, DALLAS is the only market showing INCREASED median price AND average price per square foot, while AUSTIN is exactly the opposite in both categories by showing DECREASES. Houston & San Antonio show mixed results in these pricing categories. Therefore, pricing remains mixed, without showing any clear overall direction.

The catalyst for the markets firming up and getting buyers off the sidelines is the 30-year mortgage rates. Averaging 6.75% rates for the last 15 months, doesn’t appear sufficiently low enough to bring out the volume of buyers needed to reduce the increasing inventory levels. We believe the lynchpin for strengthening sales volumes and decreasing inventories is cost of funds (interest rate) on mortgages. Pricing has remained stubbornly firm despite these perceived elevated interest rates, which may not continue to last if mortgage rates remain at the current levels.